Major home projects can be costly, which means it's important to find the best way to finance home improvement. While there are plenty of financing options available, each can have serious drawbacks in addition to their benefits. Some situations might benefit from one type over the other.

So, how do you choose? Here is a simple guide to help you figure out the best financing option for your home improvement project:

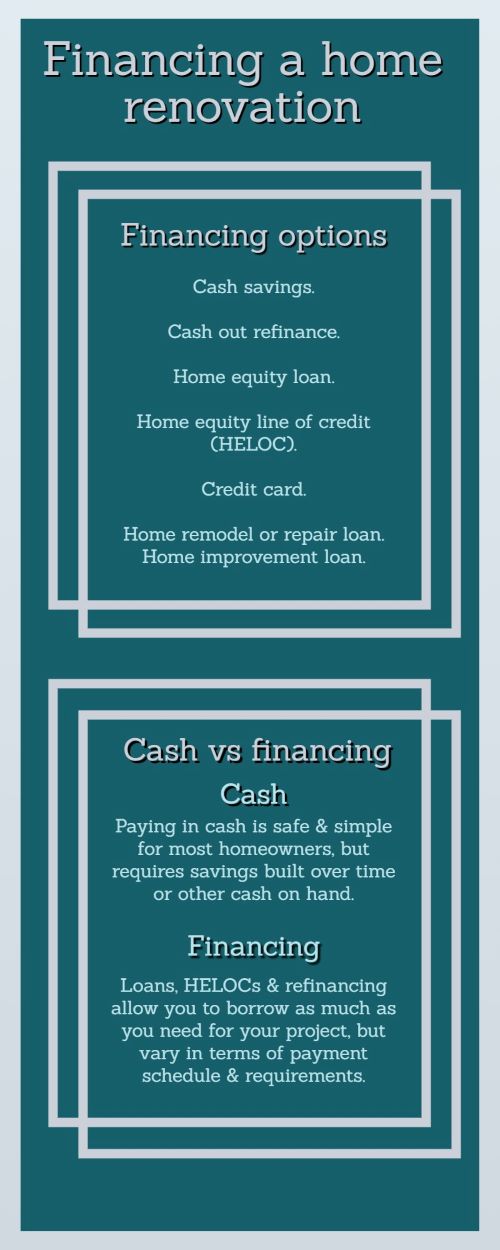

To find the best home improvement loan or financing option, you'll need to know all the options. The main ways homeowners pay for their renovations include:

When deciding between financing or cash options, there are several things to consider. Primarily, think about the scope of the project. Are you planning to remodel an entire home, or start with a smaller project? Timelines are also an important factor. Do you need to complete your remodel as soon as possible, or are you more flexible with your time?

For many homeowners, the simplest and safest way to pay for a renovation is with cash. This cash typically comes from a savings account built up over time. However, not everyone has a lump sum ready for a project, which makes loans and other financing options better for homeowners in a hurry.

If you don't have cash on hand but are responsible with monthly payments and have an excellent credit score, a loan - either an unsecured personal loan or a home equity loan - might be more helpful for your situation. Home equity loans and home equity lines of credit use the value of your home as collateral, and can offer more long-term flexibility with payments.

Ultimately, the best financial choice will come from considering your options and weighing their pros and cons. If you get stuck, remember that consulting a financial advisor or remodeling contractor can be beneficial if you ever need an expert opinion.

Selina Zhao is a tech savvy real estate agent who brings over the top-notch marketing strategies, presentation, and negotiation skills to her clients. Selina always stays on top of the real estate market trends and stats. She applies strategies into different market situation and empower her clients to achieve their ultimate goal. During the first year of her real estate career in the Bay Area, she achieved an impressive $22.8M in sales. Selina’s experience on real estate sales ensure her clients get the care and attention they need as they make the crucial decision of buying and selling properties. Selina is vowed to provide excellent service, communication, and always an advocate for her clients.

Selina loves real estate, her career blended in perfectly to her daily life, and she loves to help others to achieve their American dreams. She works restlessly to get the work done. Immigrated from mainland China in 2007, graduated from University of Miami, Selina established her own online marketing company and her real estate career in Miami, Florida before moving to San Francisco in 2017. Her soul of entrepreneurship and cares for others encouraging her to pursue to be the best in the industry. Selina is also a former Miami HEAT video producer, who witness the team winning their 2012 NBA championship at the courtside.